There is strong belief among Australians that housing market will not crash because majority people will not be willing or forced to sell for reduced price. Although it is true that majority of people will not sell at low price, there is misconception how many forced or willing sellers is necessary to crash the market.

Let's see behaviour of market stock in Australia over the past 5 years or so:

|

| Chart1 Stock on the market RPdata |

From the chart, we can see that number of homes for sale doubled since first housing troubles started in 2008. Stock slightly decreased during short boom in late 2009 - early 2010 but increased 50% since then. Similar data comes from SQM - Chart 2

|

| Chart2 - Stock on the market SQM |

From observation of a recent events in USA, I noticed that significant rise in inventories is not needed for price to crash. If we take a look at US existing house inventories (Chart 3) we can clearly see that inventories didn't increased more than inventories in Australia.

|

| Char3 - US existing home inventory |

From the chart we can see that home inventories in USA at the peak were lower than current inventory in Australia. At the peak inventories were only about 4% of total housing stock, while that percentage already passes 4.5% in Australia. It is hard to say that 4% of the total stock is extreme number that caused 33% price crash in USA. We should also notice that stock on the market fell in late 2008 early 2009 when house prices dropped the most. This means there is something else that significantly affects house prices.

Lets take a look at sales:

|

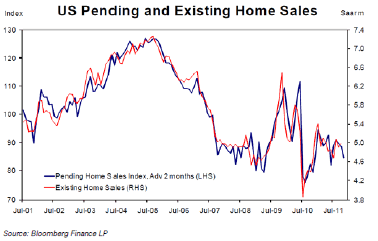

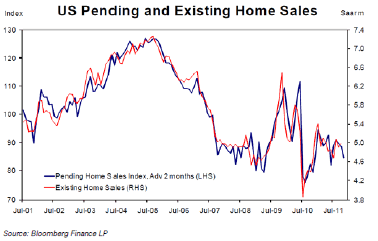

| Chart4 - US home sales |

It is clear that drop in sales, significantly affected housing market in USA. Lack of buyers seems to have much larger effect on price than rise in inventories. It is expected there will always be significant number of people forced or willing (for any reason) to sell, but it's hard to expect significant number of buyers (especially if credit freezes and/or unemployment hits).

Let's see whether this holds in Australia

|

| Chart 5 - Australia home sales |

It is clear that house price fall in 2008/2009 was caused by significant fall in sales. House prices recovered driven by new buyers although stock on market remained elevated compared to pre 2007 levels.

It looks like inventory levels at the moment are more than enough to enable market crash, it's up to buyers to set market direction. Recent drop in sales (since 2010) is larger than drop recorded in USA during the first two years of price contraction. If soon buyers do not return to the market in large numbers, we may expect price fall to accelerate. There is no need for mass panic sale for prices to fall significantly.

Now that will put the cat amongst the pigeons. I had not realised the stock on market could be so low.

ReplyDeleteSo, with the Big 2 of 4 raising rates and maybe all 4 joining in as bond markets punish our falling RBA rates and 'stong dollar' becoming less strong vis-a-vis confident.

The stage could be set for an even more rapid melt over the current slow melt which Leigh at MacroBusiness has suggested with great evidence based research.

Thank you for your post.

Hi,

ReplyDeleteNot that convinced by the argument. Something missing.

Another factor that may be more important is "distressed" listings. In WA these are most often vacant auctions. Talking to a real estate agent recently she said that 9 out of 47 of her sales last year were mortgagee sales but others in her office actually specialise here.

I think that when it becomes common knowledge that one in four new listings are "distressed" then I think the bubble will pop. We just ask the agent if it is a mortgagee sale and usually they will tell you. Sometimes they try (poorly) to lie. Not hard to pick them during an inspection.

I think the ability to get access to mortgagee data was perhaps the key why the US housing market collapsed.

A year or so ago you could use Google Maps and the real estate foreclosure option to identify millions of foreclosed properties. You could zoom in and pick one, view (image, prices etc) and compare. In a few minutes you could view hundreds of properties and get a very good understanding of the going price.

If the same was available in Australia the I suspect you would see the same as the US experience.

Regards AlanC

I think you misunderstood me. Distressed listings (forced sales) are important but their number is not so much. Even in ideal conditions there are enough forced sales (not necessarily because of mortgage defaults but because of divorces, estate sales, bankruptcies, other personal circumstances, ....). My point is that even small number of forced sales is enough to crash the market when there are no many buyers around. The key for hour housing market is continuous easy credit. If bank stop lending, house prices will crash even if interest rate goes to zero and unemployment decreases.

DeleteHi Raveswei,

DeleteYes, I agree that a restriction in credit would do it but I think this would be carefully managed by the banks. It is not in their interest for this to happen. Unlike the US, the big four work as a team and know the "rules of engagement".

In one way this is the supply side augument and I am on the other side, the demand side of the equation.

For Australia, I think demand will fall because perceived capital gains will dispate rather than an unwillingness of the banks to lend.

But unrational behaviour by the banks cannot be ruled out!

Regards AlanC

When you get sick of arguing against trolls on APF, feel free to join the new and improved Bubblepedia Forum.

ReplyDeletehttp://bubblepedia.net.au/forums/index.php