In addition to Rates of Construction and Rates of Occupancy that we presented in our last paper, we want to research construction industry activities. As a measure of a construction industry activities we will use construction employment data for the 15 years period (1996-2010) for Australian and USA states and period 1998-2010 for a few countries (we could not find data for Ireland and Spain prior to 1998). We calculated two numbers: Construction jobs as a percentage of total employment and corresponding Index. Sources of data are OECD, USA Bureau of Labour, Federal Reserve Bank of St. Louis and ABS.

First we want to show historical change of construction jobs in Australia. Data is available for a period 1984-2010. From the chart we may clearly see increase in the construction jobs during the price increase since 2000.

|

| Chart 1 – Construction Jobs in Australia |

First we want to show historical change of construction jobs in Australia. Data is available for a period 1984-2010. From the chart we may clearly see increase in the construction jobs during the price increase since 2000.

|

| Chart 2 – Construction Jobs as % of Total |

From this chart and additional data from Ireland we may see that Ireland as well as Spain have historically higher percentage of construction workers. This may be caused by different construction methods used in different countries. These methods are not equally labour intensive (full-brick and concrete in Europe, veneer brick and wood in Australia and USA). To somehow offset for these fundamental differences we created Index with the 1998 as a base year. This way we may see relative changes of the construction activities over this period.

|

| Chart 3 - Construction Jobs as % of Total - Index |

From this chart it is clear that Ireland had huge construction boom from the beginnings of 2000s with the very strong upswing in 2004. This boom lasted until crash of 2007 when construction industry collapsed below 1998 levels. Spain had much lower increase of the construction job share; it grew to 130% of 1998 levels and than dropped significantly (notice on Chart 2 that after big fall Spain percentage is still high compared to USA and UK peak levels). Australian construction jobs also grew significantly, by 2008 almost recording the same increase as Spain two years before. Australian construction jobs are still very high compared to pre-bubble period in other countries.

State Comparison

Most of the construction activities are residential, but not all. We tried to find data that shows percentage of total construction employment that is related to residential construction. We were able to find some data, in our opinion enough to show that significant majority of jobs are related to the residential construction.

|

| Table 1 – Percentage of the Residential Construction Jobs |

From Table 1 we may see that around 25% of all construction jobs in USA are not directly related to residential activities and around 15% in Australia – slightly lower percentage in Australia. Chart 4 shows that non-building (mining and infrastructure) jobs fell during the same period. This clearly shows that most of the construction boom is related to residential building construction.

|

| Chart 5 - Construction Jobs as % of Total (by state) |

|

| Chart 6 - Construction Jobs as % of Total (by state) |

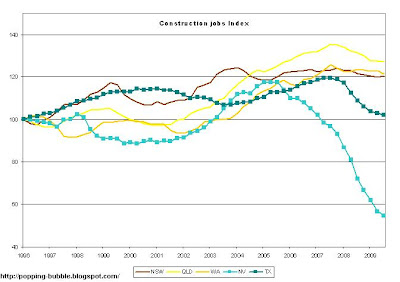

Charts 5 and 6 show construction job percentages for large Australian states (NSW, VIC, QLD, SA and WA) as well as some of the USA states used in previous analysis (CA, FL, AZ, NV and TX). We may notice that some states have significantly higher percentage in both countries. We speculate that this is consequence of large non-residential construction activities in these states (resource activities in WA and QLD and military/tourism activities in NV). Unfortunately we were not able to find adequate data to support this view.

In other states, growth was very similar over the period before the crush in USA. After USA percentages dropped in 2007 all Australian states grew even more, reaching highest levels during the period 2008-2010.

|

| Chart 6 - Construction Jobs as % of Total – Index (by state) |

|

| Chart 7 - Construction Jobs as % of Total – Index (by state) |

On charts 6 and 7 we plotted construction job index for the same period. Please, notice that almost all USA states recorded smaller increase in construction job activities than Australian states. The only exception is California, that at the beginning of the period, was still recovering from housing bubble crash from early 90s. At that time California had by far the lowest percentage of construction jobs 4%, while the lowest in Australia was SA with 5.5%. SA recored the largest growth of the construction job sector that clearly corresponds to largest Rate of Construction we calculated in our previous paper.

From all presented data we may conclude that Australian construction response to growing house prices was high relative to historical levels; it was lower than response in Ireland but very close to Spanish and significantly higher than response in USA or UK.

The response in Australian states was at least equally strong as responses in selected USA states (measured by construction employment). These USA states are currently facing huge oversupply of homes and collapsing construction industry. This just confirms our previous statements that Australia has large oversupply of homes build during the price bubble over the last decade. It also suggest potential for a big collapse of the residential construction industry that will certainly hurt overall economy.

Sources:

- Federal Reserve Bank of St. Louis Construction Employment by State

- 6291.0.55.003 - Labour Force, Australia, Detailed, Quarterly, Aug 2010

- OECD Statistics

- USA BOL Nongovernment distribution of wage and salary employment in construction by industry, 2000-2008

- ABC 8772.0 - Private Sector Construction Industry, Australia, 1996-97 ; 2002-2003

- Central Statistics Office Ireland - Index of Employment in Building and Construction